Our mission was to design and launch an end-to-end Accounting SaaS platform, replacing legacy systems and fragmented spreadsheets. The core business mandate was clear: build a modern, collaborative solution that reduces the financial close cycle, ensures audit-readiness, and provides real-time visibility for finance teams.

My Contribution: I was responsible for the end-to-end design strategy, from initial discovery and user research to leading the design process, implementing a scalable design system, and validating the solution through testing. I served as the user advocate, bridging the gap between business goals, technical constraints, and user needs.

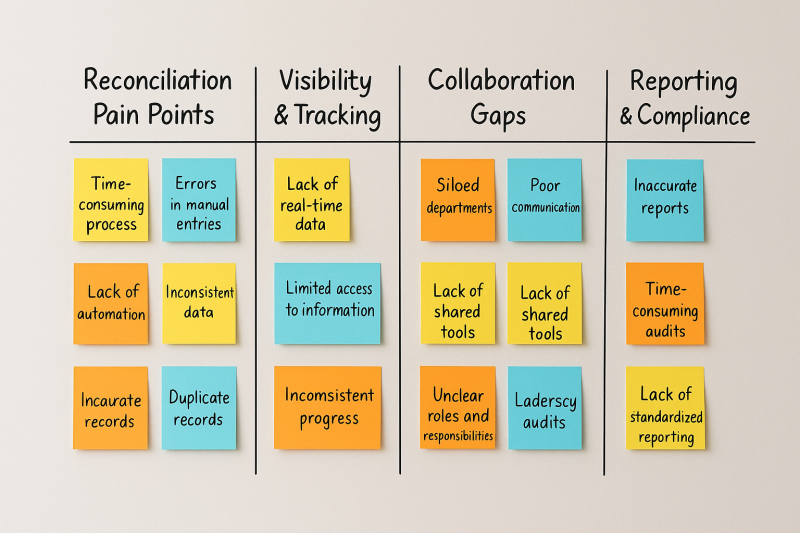

Today’s finance teams face immense pressure to do more with less. They are bogged down by manual, error-prone processes that create significant bottlenecks. Our mission was to solve these core problems head-on:

Month-end financial reporting was consistently stretching over 10 days, delaying critical business decisions.

Controllers and CFOs lacked a single, real-time view of the close progress, making it impossible to proactively address risks.

Accountants were spending countless hours on repetitive, tedious tasks, leading to burnout and a high risk of errors.

Limited collaboration between accounting and business units.

Our challenge was to design a unified platform that directly addressed these pain points, transforming a stressful process into an efficient, transparent, and collaborative one.

To build a product that truly solved these deep-rooted problems, I began with a strategic research phase focused on understanding our users and the competitive landscape.

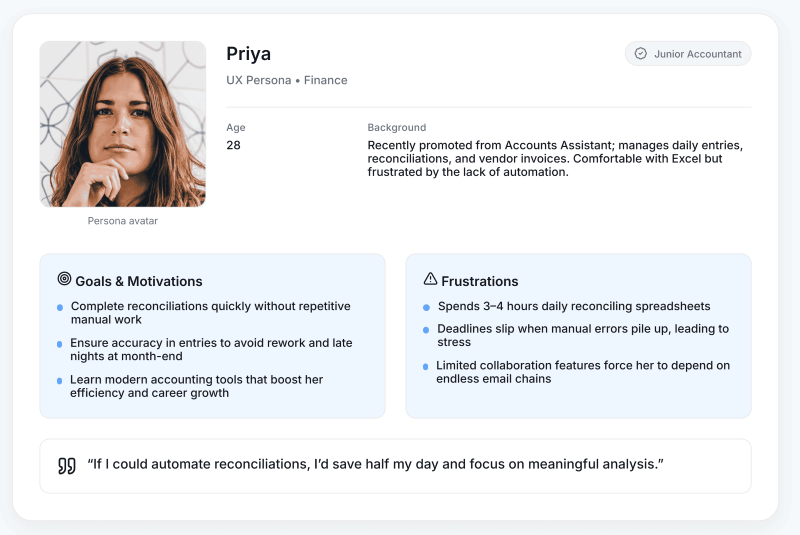

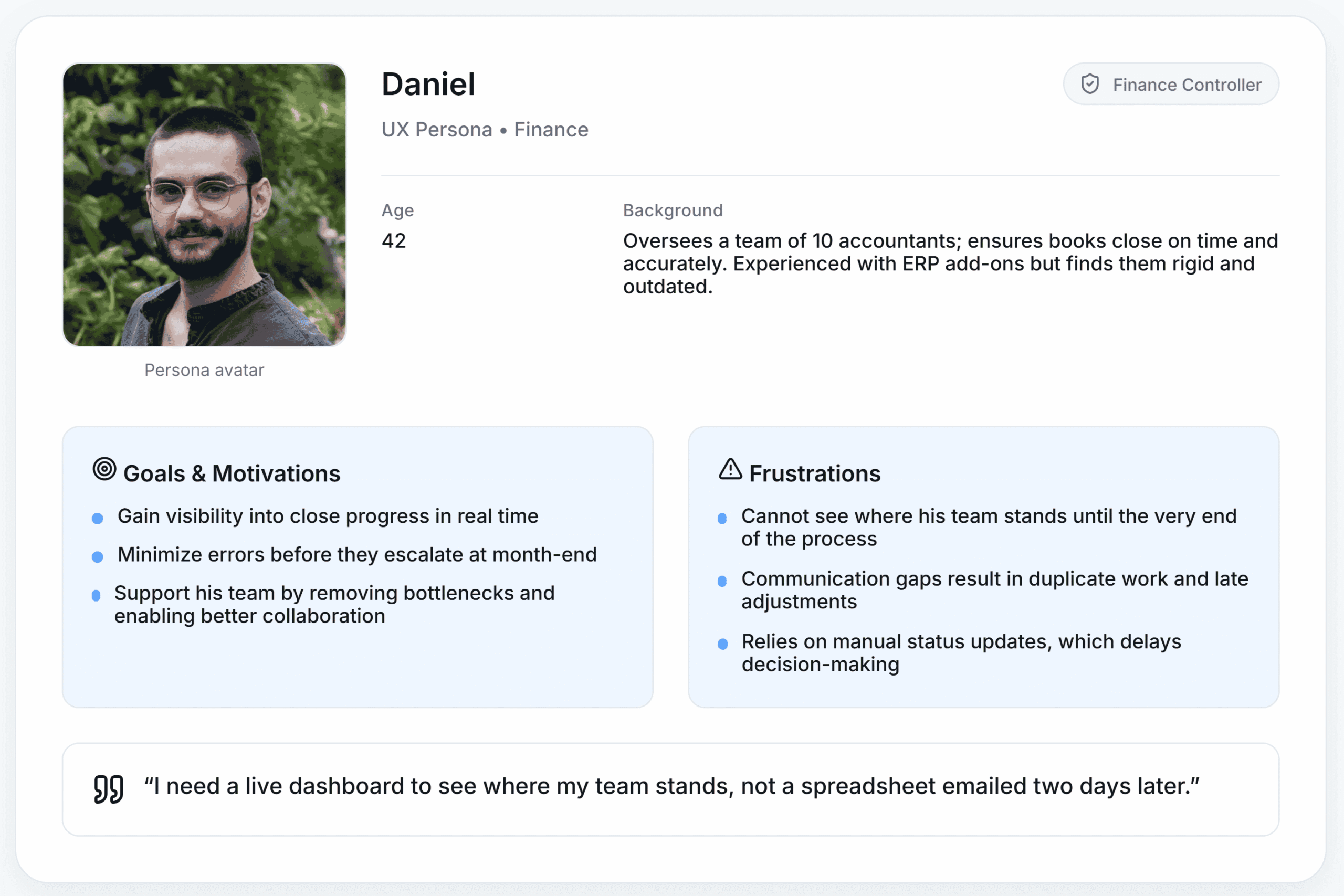

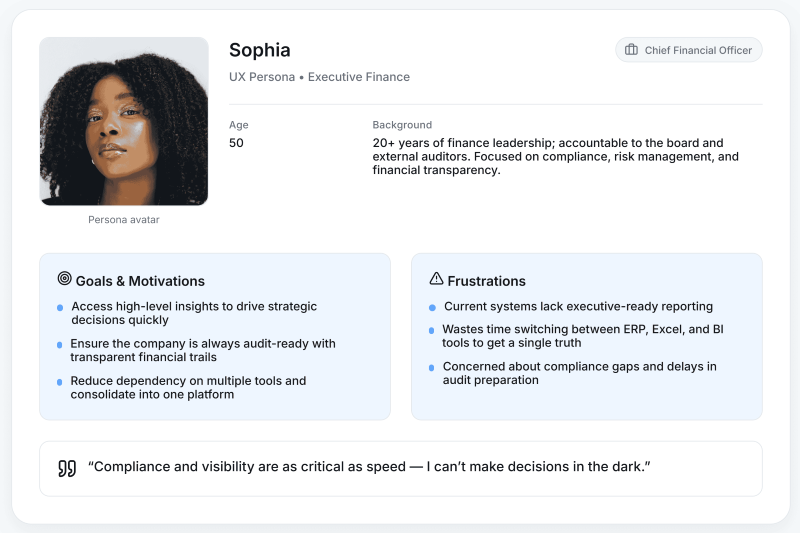

We (I & PO) conducted in-depth interviews with a cross-section of finance professionals (Accountants, Controllers, and CFOs) to uncover their daily workflows, emotional pain points, and core needs.

I conducted a deep-dive analysis of competitors like FloQast, Canopy, Keeper, Recogent, and Firmway to identify market gaps and opportunities for differentiation

| Vendor | Category (What it is) | Core Modules / Capabilities | Typical Integrations | Strengths (UX / Positioning) | Considerations |

|---|---|---|---|---|---|

FloQast Close management & accounting ops |

Close orchestration, automated reconciliations, AI transaction matching, journal entry management, variance analysis, evidence collection, ERM | Month-end checklists, reconciliations, evidence repository, audit trails, AI-assisted narratives | NetSuite, Sage Intacct, Microsoft, SAP, Xero (ERP/GL ecosystem) | Deep accounting-first workflows; audit-readiness; strong AI assist; tailored for close teams | Enterprise/mid-market focus; pricing not public; setup/change management required |

Canopy Practice management for accounting firms |

Client engagement & portal, document mgmt, workflow automation, time & billing, payments, tax resolution | Client portal, document storage, workflows, billing, payments, secure messaging, AI insights | Google & Microsoft (mail/calendar), QuickBooks Online, IRS e-services, Zapier, OpenAI, Public API | End-to-end firm OS with strong client communication and billing; modern portal and mobile | Firm ops focused (not GL close); some features gated by plan/tiers |

Keeper Bookkeeping QA & firm management |

File review & QA, client portal, tasking, reporting/KPIs, management reports | Automated checks, checklist workflows, client communication, per-client dashboards | QuickBooks Online, Xero (live-sync) | Built for bookkeeping teams; fast setup; lightweight modern UI; transparent per-client pricing | Best with QBO/Xero clients; narrower scope vs full practice mgmt or close platforms |

Recogent AI reconciliation & confirmations (emerging) |

AI-assisted vendor statement reconciliation, transaction matching, data extraction, confirmations | Automated matching, OCR/data extraction, confirmation workflows, reconciliation suggestions | Typically demo/partner integrations (limited public list) | High automation/accuracy aim for reconciliations; AI-first proposition | Limited public detail; early-stage product—validate security, compliance, integrations |

Firmway Confirmations & compliance automation (India-focused) |

Balance & audit confirmations, MSME checks, GSTR-2B & Form-26AS reconciliations, dashboards, OTP-verified responses | Bulk confirmations, audit trail, statutory reconciliation modules, regional compliance features | Integrations with accounting software; India-specific statutory systems and workflows | Strong for India compliance flows; automated outreach and high response rates for confirmations | Regional focus; not a full practice mgmt/close platform; pricing not always public |

A single dashboard wouldn't work. Accountants needed a granular, task-oriented view, while controllers required an aggregated progress overview, and CFOs demanded a high-level strategic snapshot.

Repetitive tasks like bank reconciliations were a major source of friction and time waste. Users craved intelligent, error-reducing automation.

In this domain, trust is paramount. Features that demonstrated a clear, immutable audit trail were seen as a core value proposition, not just a nice-to-have.

Based on our research, I developed three core personas that guided all design and development decisions. This ensured every feature was built with a specific user and their goals in mind.

I led a lean, iterative design process, focusing on quick cycles of design, feedback, and refinement.

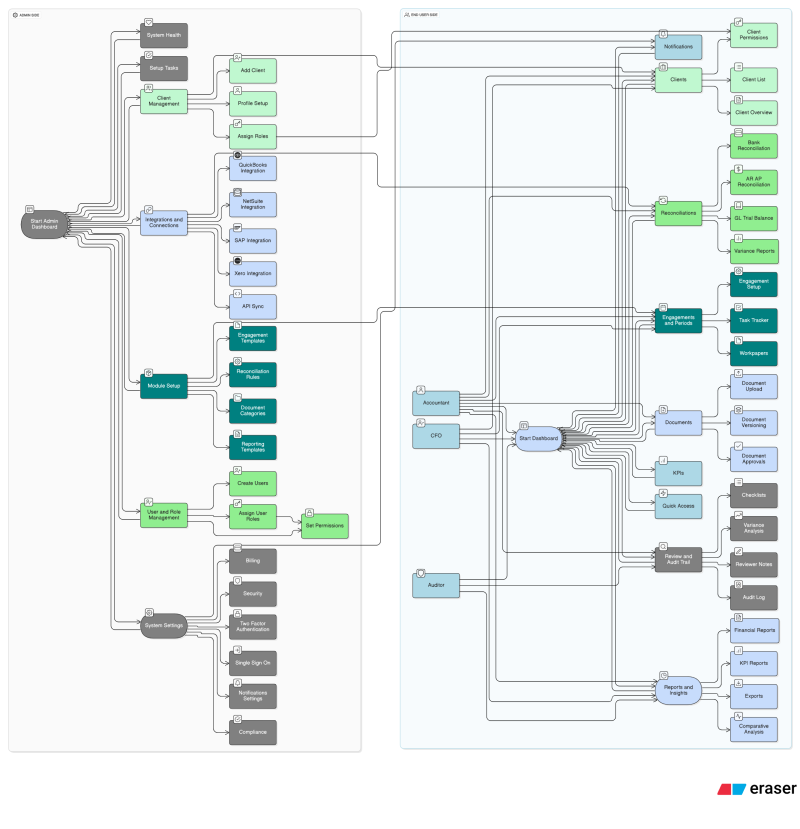

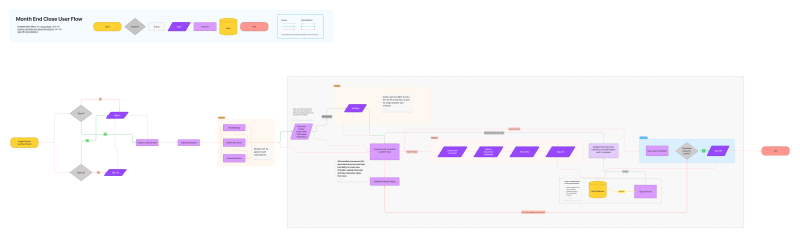

I started by mapping the end-to-end user journey, from initial task assignment to final report generation. This ensured a logical, role-based flow that minimized cognitive load. The following user flow diagram illustrates the core pathways for each of our primary personas.

I then translated this high-level journey into detailed user flow diagrams, visualizing the specific steps each persona would take to complete key tasks like reconciling accounts. This allowed us to identify potential pain points and streamline the process before any UI was designed

Validation was a non-negotiable part of our process. I created a high-fidelity prototype in Figma and conducted usability tests with 5 participants representing our core personas.

Initial user tests revealed our automated matching process was confusing. In response, we simplified the interaction to a "match, review, approve" flow, which reduced task completion time by 40%.

We learned that controllers needed more than just a progress bar. We added a "risk score" to the close dashboard, using smart alerts to proactively highlight tasks at risk of being late.

Testing showed that while custom reports were desired, CFOs also wanted a pre-built "Executive Summary" view. We added an AI-driven report suggestion feature to surface key metrics instantly.

Our design choices translated directly into significant business value and a dramatically improved user experience.

The average month-end close was reduced from 12 days to just 6 days

Our simplified reconciliation flow reduced the average time-on-task for accountants

Qualitative feedback from users highlighted the intuitive interface as a major factor in boosting morale and reducing stress

Automated record-keeping and clear audit trails streamlined external audits, saving an estimated 20+ hours per quarter

This project underscored the power of a user-centric approach in a highly complex domain. My key takeaways are:

This project was a transformative journey in redefining how finance teams navigate the complexities of month-end close processes. By deeply understanding user needs, leveraging iterative design, and fostering cross-functional collaboration, we delivered a platform that not only solved critical pain points but also set a new standard for efficiency and transparency in accounting workflows. The quantifiable results—halving close cycles, boosting team satisfaction, and ensuring audit readiness—demonstrate the tangible impact of user-centered design. Moving forward, this case study serves as a testament to the power of empathy-driven solutions and iterative innovation, paving the way for future advancements in financial technology.